INFORMATION FOR CASUALS

Changes for casual employees under the Protecting Worker Entitlements Act 2023.

Learn more

PROTECTING WORKER ENTITLEMENTS

Information for employers about changes as part of the Government's Protecting Worker Entitlements laws.

Learn more

LOGIN

LOGIN

03.

Determining eligible wages

Purpose of this Guidance Note

This information aims to assist employers to understand Coal LSL’s views on what eligible wages are for the purposes of calculating the payroll levy. It is not intended as legal advice.

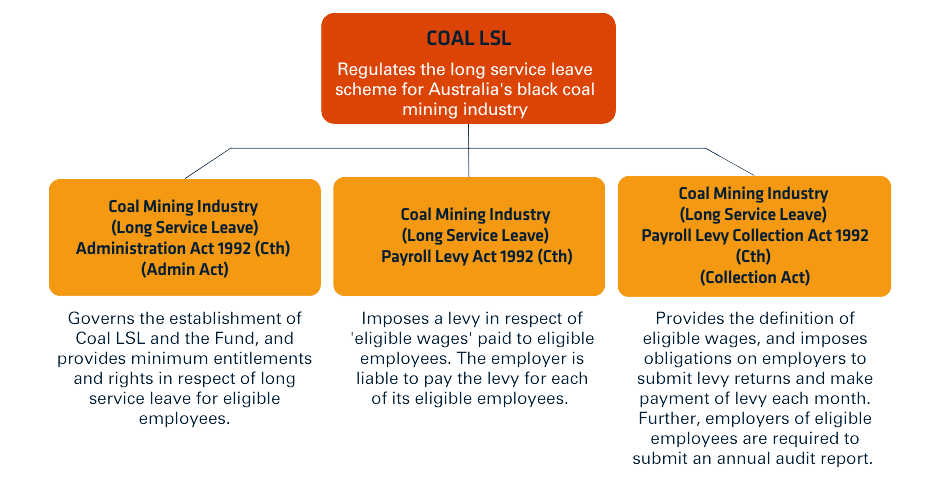

Overview of the long service leave scheme

What are eligible wages and how are they calculated?

Under the legislation, employers of eligible employees are required to pay the payroll levy to Coal LSL.

The amount of levy to be paid depends on the amount of eligible wages paid to the eligible employee. From 1 July 2023 employers are required to pay 2.7% of an employee's eligible wages each month. Employers must ensure that they properly calculate each of their employee's eligible wages for the month in accordance with the Coal Mining Industry (Long Service Leave) Payroll Levy Collection Act 1992 (Collection Act).

Employers must establish which definition of 'eligible wages' is relevant for each of their eligible employee, based on whether the employee is:

paid a base rate of pay and is not a casual employee

paid an annual salary

a casual employee.

Refer to Section 3B of the Collection Act for the definition of ‘eligible wages’ when calculating the payroll levy.

Employee who is paid a base rate of pay and is not a casual employee

For these employees, ‘eligible wages’ are the greater of the following (either Formula A or Formula B):

Employers should not set an automatic levy payment based on Formula A or Formula B because this may lead to an underpayment or overpayment of levy as the wages paid vary each month. Rather, the calculation must be applied to each employee, each month.

For an eligible employee who is paid an annual salary

Eligible wages are the annual salary paid to the employee, including any incentive-based payments and bonuses which are paid at least once per month (not including those which are only paid quarterly, half yearly or annually). The calculation of eligible wages excludes overtime or penalty rates and shift loading.

For an eligible employee who is a casual employee

As of 1 January 2024, the method for calculating a casual employee’s eligible wages has changed and now depends on whether the casual employee’s casual loading is able to be quantified:

Please refer to s16 of the Fair Work Act 2009 for the ‘base rate of pay’ in the definition of eligible wages.

When are eligible wages calculated?

The Coal Mining Industry (Long Service Leave) Payroll Levy Collection Act 1992 (Collection Act) requires an employer to submit the payroll levy to Coal LSL no later than 28 days after the end of a month in which an eligible employee is employed.

As the calculation of eligible wages must consider the amounts, as outlined above, which are paid to the employee in a month, an employer should:

calculate those wages at the end of the month, or

if no further payments are due to be paid to the employee before the end of the month, calculate those wages at that time.

An employer’s calculation of the payroll levy may be the subject of enquiries by Coal LSL. Please ensure the monthly payroll levy for each eligible employee is correctly calculated, as set out in section 3B of the Collection Act.

Workers compensation or other income protection payments

When an employer’s eligible employee is receiving workers compensation or other income protection payments directly from an insurer or other source, the employer is not required to include those amounts when calculating the eligible wages (if any) paid to the employee during the month.

However, if the employer receives a compensatory payment which results in the employee being paid in the ordinary way by the employer then the employee's eligible wages are to be calculated as described in this guidance note.